The Wall Street Journal yesterday conveyed assessments from top financial experts describing Iran as “Turkey with oil” and outlining “a growing consensus that the withdrawal of sanctions on [Iran]… would be a huge boon for the country, the region and for investors who get in early.”

“Tehran feels like Ankara did in 2004,” Mr. Robertson, Rennaisance’s global chief economist, wrote in a report on his recent trip. “Iran has a broad manufacturing base – which produced 50% more cars than Turkey in 2011 – but unlike Turkey, it has 9% of the world’s oil reserves and a large current-account surplus.”

Robertson said in his report. Under Mr. Rouhani’s guidance, Iran is making monetary and budgetary adjustments emerging-market investors tend to like, which have tamed inflation and – perhaps more importantly – stabilized the country’s free-falling currency. “This looks to us like a potential re-rating play that could – in an investable scenario – attract those investors who have recently invested in Saudi Arabia, like those who invested in Turkey after 2001 and Russia since the 1990s,” Mr. Robertson wrote.

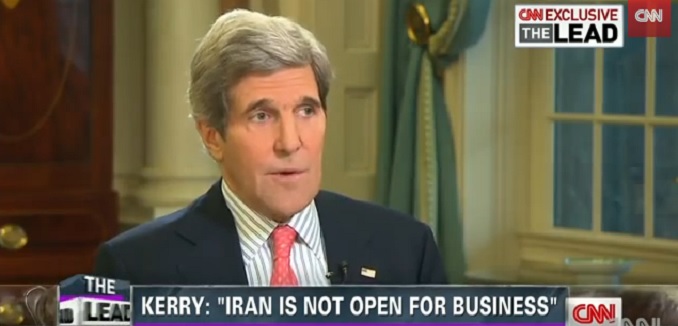

Brushing aside objections from U.S. officials that Iran is not open for business – a talking point that has been prominent in White House defenses of the interim Joint Plan of Action (JPA), and that the Journal cited U.S. Secretary of Commerce Penny Pritzker as having recently reemphasized – the outlet noted that investors see “the scale of Iran’s potential is hard to ignore.” At stake is the degree to which the initial erosion in sanctions under the JPA may lead to an international gold rush that would substantially erode the rest of the sanctions regime, enabling Iranian leaders to walk away from talks aimed at putting the Islamic republic’s atomic program beyond use for weaponization.

Skeptics had predicted a gold rush-style downward spiral, in which nations and companies scrambled not to get left behind as Iranian markets were reopened to the world. The Obama administration and analysts linked to the administration had derided those scenarios are among other things “fanciful.” Recent months have seen empirical evidence pile up on the side of the critics. Evidence that the Obama administration misjudged the dynamics surrounding Iranian diplomacy are likely to fuel calls, already supported by lopsided majorities of Americans, for a stronger Congressional voice in determining the path of negotiations.

[Photo: CNN / YouTube]