If you’re in the market for a new house in North America, your first stop might be a home-valuation estimate website like Zillow. But what if you’re an investor looking to buy an apartment complex?

Enter Skyline AI, which uses artificial intelligence, machine learning and big data to predict what a commercial real-estate investment is worth today and how it may perform in the future.

The Tel Aviv-based startup raised $18 million in August – just four months after launching to the public – on top of a $3 million seed round last year. The new financing came from Sequoia Capital and TLV Partners with participation from JLL Spark.

Skyline AI is not just a technology vendor; the company has real skin in the game. Teaming up with an investment partner, Skyline AI identified two residential complexes in Philadelphia that the company’s algorithms determined were performing below market. Skyline AI and its partner then spent some $26 million to buy the properties.

“We saw that similar assets that had already been renovated were able to increase their rents by about $300 per unit,” Skyline AI CEO Guy Zipori tells ISRAEL21c.

Identifying this kind of “mismanaged opportunity” on a national scale without Skyline’s smarts would be close to impossible. Real-estate investors do a lot of manual due diligence including visiting a property in person, says Zipori. With Skyline AI, it’s all done algorithmically and in real time.

The latter is particularly important: Commercial properties are usually appraised only once or twice a year. “Every time something changes around an asset, our appraisal changes immediately,” Zipori says.

Zipori recalls how he and his cofounders came up with the idea for Skyline AI at a conference for real-estate investors. At the end of one talk, Zipori raised his hand.

“Are you using any technology in the underwriting process?” Zipori asked.

The speaker thought for a few seconds, then responded, “Of course we use technology. We all use computers and all the analysis is done using Excel files.”

“That’s when I understood there’s room for innovation in this space,” Zipori says. “They’re making decisions worth hundreds of millions of dollars.”

Zipori and his Skyline AI cofounders have been living and breathing big data for more than a decade – first with the healthcare startup iMedics in 2007 (“it was like Facebook for hypochondriacs,” Zipori explains) and later in the security space with Visionize, a 12-person company they sold to AVG in 2011 for $15 million. It now has 180 employees.

10,000 data points

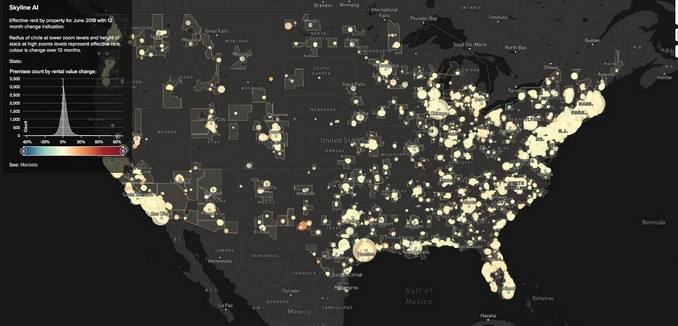

Skyline AI is a big-data scientist’s dream. The software crunches the numbers from 130 data sources – “some public, some private and some proprietary,” Zipori says – covering nearly 10,000 data points going back up to 50 years.

“We try to put our hands on every piece of information that might affect real-estate values – demographics and crime, restaurants in the area as well as more macro data from the Treasury Department.”

In this way, the company monitors every property in the US with more than 50 units. That comes out to just under 400,000 properties, Zipori says. “We already have the largest dataset that exists in real estate.”

It would be easy to describe Skyline AI as a kind of Zillow for commercial real estate, but the company is not building a tool for individuals, nor is it looking to license its technology to other investors. Skyline AI keeps its tech to itself.

When the company’s capital markets team identifies a property worth buying, it raises funds or forms a joint venture with a large private equity group or financial institution. That’s how the $26 million Philadelphia purchase happened.

Real-estate lending, investment and advisory firm Greystone Labs is Skyline AI’s newest partner. The two announced a data-sharing agreement in July that will add Greystone’s “key industry insights” to Skyline AI and give Greystone access to Skyline’s technology in order to “underwrite loans faster and with greater accuracy than the competition.”

Skyline is not the only startup trying to apply AI to the lucrative real-estate market, estimated to hit $4.26 trillion by 2025. Others include AlphaFlow, Ten-X, Jointer.io and Opendoor, though none of these is Israeli.

When we spoke to Zipori, he was in the midst of moving his family to New York, where he’ll run Skyline’s US office. The R&D headquarters will remain in Tel Aviv’s trendy Neve Tzedek neighborhood. The company currently employs 25 people with plans to double in the next 18 months, Zipori says.

Multifamily properties are just Skyline AI’s go-to market strategy, Zipori says. “We started here because there’s a lot of data available and it’s a great seed for our technology. But we’ll also look at other asset classes in the future, everything from retail to office to industrial buildings.”

Will all this technology eventually put real-estate brokers out of business? Not at all, Zipori says.

“It’s like developing a helmet for the F-16 fighter jet,” he says. “You still need a good pilot to fly the plane. The helmet provides him with information in real time to make better decisions in the air.”

(via Israel21c)

[Photo: Israel21c ]