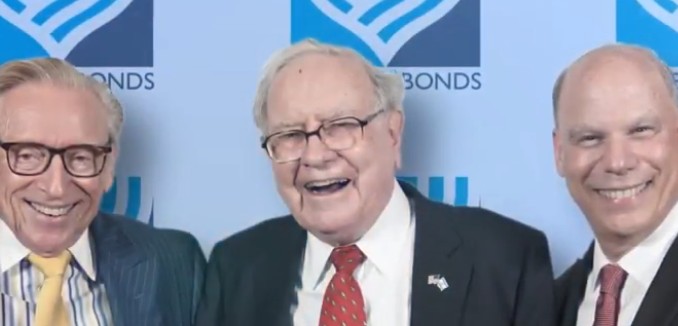

An Israel Bond event hosted by Berkshire Hathaway Chairman, President & CEO Warren Buffett in Omaha, Nebraska last week raised over $80 million in Israel bonds investments and intentions to invest, The Jerusalem Post reported.

“I’ve lived through Israel’s entire 70-year history and I believe it is one of the most remarkable countries in the world (…) I’m delighted to own Israel bonds,” the billionaire and internationally famous investor and philanthropist said. Buffet remarked that Israel’s independence was “a good day for the world.”

When asked why he’s committed to investing in and for Israel, Buffet stressed the strong bilateral relationship between the United States and Israel, saying the two countries “will always be linked.” He added “I have nothing but good feelings about what I am doing (…) It is a good thing for Israel that there is an America, and it is a good thing for America that there is an Israel.”

The event at the University of Nebraska Medical Center’s Fred & Pamela Buffett Cancer Center was attended by over 70 investors from the U.S. and Canada, as well as Israeli dignitaries and members of the diplomatic corps.

Shai Babad, Director General at Israel’s Finance Ministry; Ambassador Danny Danon, Israel’s Permanent Representative to the United Nations; and Ambassador Dani Dayan, Consul General of Israel in New York, spoke at the event.

Babad told the attendees, “We just don’t see you as investors, we see you as great friends of Israel,” citing record foreign investment, low unemployment, and consistent GDP growth in Israel.

Israel Bonds President & CEO Israel Maimon added: “The Israel Bonds organization has played a significant role in the realization of one of Israel’s most remarkable accomplishments – the building of a robust, resilient economy. Investors the world over, including Warren Buffett, have taken notice.”

Previously, Buffett purchased $5 million worth of bonds at a 2016 event in Omaha, at which $60 million in bonds were sold. At the time, Buffett said that if you’re looking for “brains, energy and dynamism,” Israel was the place to go.

Buffett’s initial investment in Israel was in 2006, when his company Berkshire Hathaway bought an 80% stake in Iscar, an industrial toolmaker for $4 billion. In May 2013, Berkshire Hathaway bought the remaining 20% of the business for $2 billion. At the time he called Israel the “most promising investing hub outside of the United States.”

In addition to Buffett’s own investments in Israel, some of those who invested with him have also put their money into the Jewish state. In June 2016, the estate of Howard and Lottie Marcus, Holocaust survivors who had made a fortune investing with Buffett, left a historic $400 million bequest to Ben-Gurion University, which is believed to be the largest individual gift ever made to an Israeli university. “Knowing them, it comes as no surprise that they elected to use their financial success to enhance the lives of thousands of Israeli young people,” Buffett said in a statement.

[Photo: Israel Bonds / YouTube ]