Dropping oil prices are taking a toll on Iran’s economy. Last week many Iranians rushed to sell their local currency holdings out of fear for their savings, the Al-Arab newspaper (Arabic link) reported on Tuesday. This prompted a loss of more than 10% of the rial’s value in one week.

Currently, one American dollar is trading for 35,600 rials. The ISNA (Persian link) Iranian news agency reported that this decline is exceptionally high in comparison to last year, and is the sharpest decline in the currency’s value since President Hassan Rouhani was elected.

The drop in oil prices has offset economic gains that Iran has realized due to sanctions relief. According to Bloomberg News, Iranian oil is now selling at about $100 a barrel, well below the $136 a barrel that Iran needs to break even on their government spending. The Financial Times reported in October that “Iran’s economy also grew 4.6 per cent in the three months to August 22 compared with the same period of 2013, while the currency market has also been stabilised.” Notably, inflation fell from 40% to 21% over the course of Rouhani’s first year in office.

After intensive negotiations in Vienna last week, Iran and the P5+1 powers decided to extend the nuclear talks until July 2015 to try and reach a final agreement about Iran’s nuclear activity. The agreement to extend negotiations includes the release of an estimated $700 million a month in frozen funds to Iran.

Iran’s economy is currently beset by hyper-inflation and high rates of unemployment. Analysts believe that the rial crisis will bring Iran into “unprecedented trouble and challenges.”

“This is the biggest concern of the government of Hassan Rouhani,” a financial commentator told the Al-Arab newspaper (Arabic link).

The Iranian government has attempted to downplay the severity of the falling rial. Iran’s economy minister called on residents to stop buying foreign currencies, while the governor of the Central Bank of Iran, Valyollah Seif, promised that the exchange rate will soon stop falling and that Iranian markets would “stabilize.”

Meanwhile, several critics within Iran argue that the country’s economic woes are not exclusively the fault of the sanctions, Strategy Page reports.

“The corruption, government mismanagement and falling price of oil are serious economic problems that have nothing to do with sanctions. Many economists, inside and outside Iran, point out that even if all sanctions were lifted Iran would still be suffering from serious economic problems (inflation, unemployment and persistent recession). The Iranian government ignores this sort of view and tries to limit its spread inside Iran.”

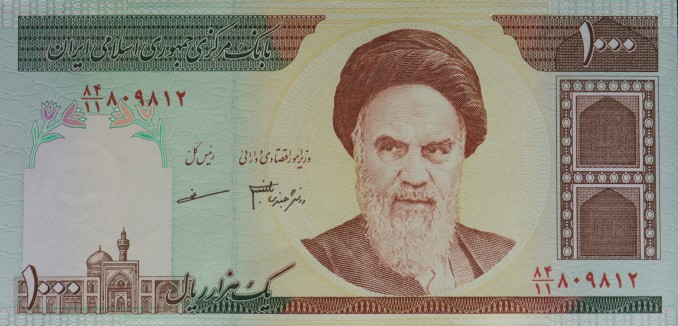

[Photo: James Malone / Flickr]