June 26, 2014 marked the first anniversary of when the Market Vectors Israel Exchange Traded Fund (or ETF) started trading on the New York Stock Exchange.

According to the NASDAQ website, an ETF is a fund that tracks a stock index. The Market Vector Israel ETF (NYSE: ISRA) is based on BlueStar Global Investor’s BlueStar Israel Global Index (BIGI).

A press release (.pdf) from BlueStar earlier this week explains:

ISRA began trading on the New York Stock Exchange on June 26, 2013, with less than $10 million in assets under management, becoming the second Israeli equities ETF to hit the market. ISRA now boasts approximately $48 million in assets under management, and is growing in recognition for investment in Israeli Global Equities. BIGI® had its semi-annual index rebalance today, resulting in a benchmark with 114 Israeli constituent companies listed in Tel Aviv, New York and London. …

BIGI®, the index developed by BlueStar Global Investors that ISRA tracks, is the first benchmark to fully capture the complete range of companies that undergird Israel’s economic success, what BlueStar calls ‘Israeli Global Equities.’ From the launch of ISRA in June 2013 until the end of May 2014, BIGI® returned approximately 25%, while the S&P 500 … returned approximately 21%.

One of BlueStar’s goals is increasing the investment of Jewish organizations in Israel “using BIGI as their benchmark and ISRA as their investment vehicle.” They have had some success in this area:

These not-for-profits include more than 10 Jewish Federations, such as the Greater Miami Jewish Federation, the Jewish Federation of Metropolitan Chicago, and the Jewish Federation of the Greater East Bay. The Jewish Communal Fund of New York (JCF) now also provides ISRA as an investment option on its donor advised platform. JCF is the largest Donor Advised Fund for the Jewish Community, with 3000+ participants and $1.2B in assets.

In Joining the Startup Nation Just Got a Lot Easier, which appeared in the March 2014 issue of The Tower Magazine, Ben Cohen profiled Bluestar and its founder Steven Schoenfeld. Schoenfeld explained the strategy behind developing the index.

A self-confessed “quantitative nerd” who previously worked as an indexing expert for gargantuan investment firms like BlackRock and Northern Trust, Schoenfeld set about developing a methodology to both maximize returns in the Israeli market and show the country’s true worth. From the outset, that meant broadening the definition of Israeli companies beyond the restriction of a Tel Aviv listing. In determining whether a company is Israeli, and therefore valid for inclusion in the BlueStar Israel Global Index (BIGI), a number of quantitative and qualitative criteria have to be met. These include whether a company is headquartered in Israel, whether its tax status is in Israel, and whether the company has major Research and Development or logistical facilities located in Israel. Take Wix as an example: while the bulk of its market is in the U.S., the majority of its staff working in R&D are domiciled in Israel.

By including Israeli companies listed on foreign exchanges in the BlueStar index, “it almost doubles Israel’s size in stock market terms,” said Schoenfeld. No less important is the diversification of Israel’s market. While Israel is known for its technological innovations, technology companies compose 31 percent of the BIGI, with strong representation of other sectors such as health care (28 percent,) financial services (19 percent) and energy (six percent.)

Last year when starting the fund, BlueStar explained that “the investment environment in Israel as the “best of both worlds: the superior economic management of a developed market, but with emerging market growth characteristics.”

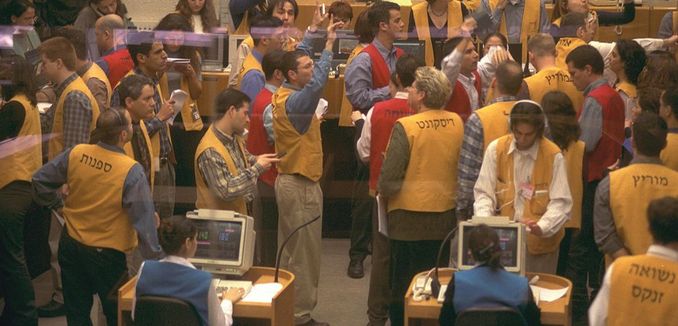

[Photo: Government Press Office / WikiCommons ]