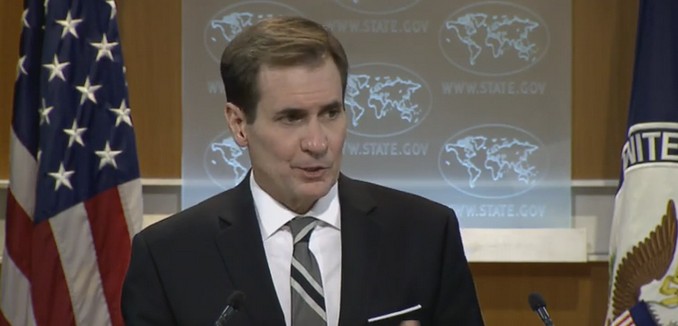

State Department spokesperson John Kirby declined to address growing concerns from experts and Congress about the Obama administration’s reported plans to extend additional sanctions relief to Iran during a press briefing on Tuesday.

Associated Press correspondent Matt Lee pointedly asked Kirby if, “despite assurances that the Administration gave to lawmakers over the course of the negotiations on the nuclear deal,” the White House is in fact “preparing to open up a backdoor for the Iranians to use – to get into and use the [United States] financial system?”

Kirby deflected the question several times, telling Lee to direct it to the Treasury Department instead. He added that the administration intends to meet all its “commitments and obligations” under the nuclear deal with Iran, and that it will “continue to consult with Congress on the way ahead,” but failed to explicitly deny an intent to allow Iran access to the American banking system.

“I have to say that doesn’t sound like it’s going to ease any of the concerns on the Hill,” Lee commented in the end.

The exchange came amid criticisms by experts and lawmakers about the administration’s reported openness to grant Iran additional, non-nuclear sanctions relief and access to U.S. financial markets. Critics argue that such a move would endanger the global financial system and cause a collapse of the sanctions regime against Iran.

Previously, the White House wrote that “non-nuclear sanctions (such as for terrorism) must remain in effect and be vigorously enforced.” The administration assured Congress that Iran would not receive access to the U.S. financial system or dollar transactions. Treasury Secretary Jack Lew insisted that “Iranian banks will not be able to clear U.S. dollars through New York… or enter into financing arrangements with U.S. banks.” However, when asked last week about these commitments, Lew appeared to leave the door open to granting Iran additional sanctions relief, including access to the U.S. financial system. The administration’s newfound willingness to consider lifting additional sanctions, beyond those that were lifted in accordance with the nuclear deal reached last July, comes amidst Iranian demands for further sanctions relief.

In an op-ed published Monday in The Wall Street Journal, Executive Director Mark Dubowitz and Vice President for Research Jonathan Schanzer of the Foundation for Defense of Democracies, argued that providing Iran with additional sanctions relief would deprive the U.S. of leverage over Iran with regards to its support for terrorism, human rights violations, and ballistic missile development, while poisoning the global financial system. The Financial Action Task Force, a global anti-terrorism financing body, has warned that Iran’s “failure to address the risk of terrorist financing” poses a “serious threat… to the integrity of the international financial system.” Likewise, in 2011, the Treasury Department labeled Iran a “jurisdiction of primary money laundering concern,” citing Iran’s “support for terrorism” and its “illicit and deceptive financial activities.”

Lawmakers have also voiced concern. Congressman Ron DeSantis (R-Fla.) warned, “Further sanctions relief would mark the death knell for U.S. sanctions and would represent a boon to the Iranian regime and its Revolutionary Guard Corp.” Senator Mark Kirk (R.-Ill.) argued that any administration effort to grant Iran access to U.S. financial markets and US dollars “ignores American laws and the Financial Action Task Force… Such an effort would benefit Iran’s terror financiers while fundamentally undermining the USA PATRIOT ACT 311 finding that Iran’s entire financial sector is a jurisdiction of primary money laundering concern.”

A video of the exchange between Lee and Kirby is embedded below.

[Photo: U.S. Department of State / YouTube ]